A Smarter Solution

Traditional debt collection methods are often time-consuming, inefficient, and can damage customer relationships.

The Problem

The Solution

The Results

Collectors struggle with:

- Confusing Communication: Generic collection tactics often alienate debtors, leading to frustration and resistance.

- Wasted Time & Resources: Chasing down the wrong leads and manually sifting through data consumes valuable time and resources.

- Limited Insights: Traditional methods rely solely on financial data, hindering effective communication and personalized strategies.

CollectABILITY leverages the power of AI to transform your collections process by providing:

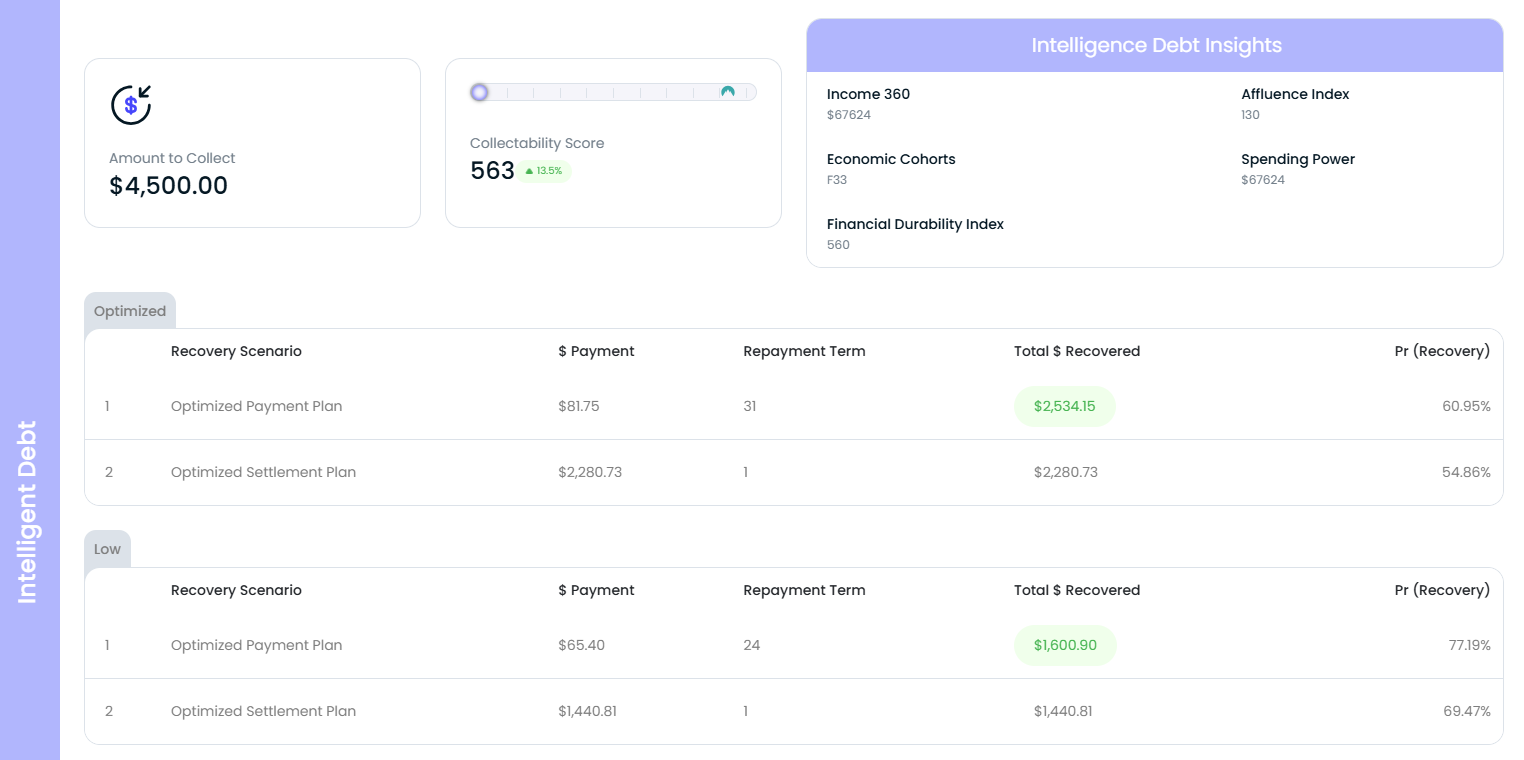

- Debtor Scoring: Identify the most responsive debtors with AI-powered scoring. Prioritize “low-hanging fruit” to maximize collections and efficiency.

- Personalized Recovery Options: Craft targeted offers based on current and real-time data insights, fostering positive interactions and improving recovery rates.

- Holistic Debtor View: Go beyond traditional data. We utilize non-traditional sources to understand your debtors better and develop effective collection strategies.

- Increased Recovery Rates: AI-powered prioritization and communication lead to significantly higher collections success.

- Improved Customer Experience: Personalized interactions build positive relationships and reduce collection friction.

- Data-Driven Decisions: Gain valuable insights to continuously refine your strategies and optimize your collections process.

The IntelligentDebt™ AI

CollectABILITY offers a suite of solutions designed to seamlessly integrate with your existing products and workflow to tackle your recovery challenges. Here’s how you can empower your team:

Web Search Portal

API Access

Batch Append

Our user-friendly web app provides on-demand access to CollectABILITY’s features, giving your team the flexibility to manage cases directly in a central hub.

Effortlessly integrate CollectABILITY and the IntelligentDebt™ Algorithm with your existing systems to communicate effectively and improve recovery rates. With simple setup and clear usage based pricing, easily enhance your recovery efforts with our state of the art scoring and revocery matrix.

Process large volumes of data for analysis with ease, allowing you to optimize collection strategies in bulk and scale as needed. Utilize our self-service portal for smaller batches (<10k lines at a time), or coordinate larger batches with us directly. Append each debtor record with the CollectABILITY Score, IntelligentDebt Insights, Recovery Recommendation scenarios, and Contact Info input validation. Get started by signing up for API access to get your keys and scema.